Will Stocks Trend Higher in 2018?

One of the most challenging part of my job as a financial planner is calming clients down during periods of stock market decline. Thankfully, I didn’t have to experience that in 2017.

One of the most challenging part of my job as a financial planner is calming clients down during periods of stock market decline. Thankfully, I didn’t have to experience that in 2017.

The U.S. stock market clocked a return of more than 21%. International stocks performed even better, rising by more than 27%. Everyone I interacted with was ecstatic about their 401(k)’s performance.

A common question I encounter is, will stocks continue their upward trend in 2018? Will we see a correction (sudden downturn) sometime soon? The short answer is, I don’t know, and neither does anyone. Not Jim Cramer, not Warren Buffett, not Donald Trump.

What we do know is the following:

1) The upcoming tax cuts will increase the profits of U.S. corporations and give a short-term stimulus to the U.S. economy. This bodes well for U.S. stocks. But how much of this expectation is already reflected in its price?

2) The U.S. stock market is expensive. It’s like paying $300 for a dinner at Le Diplomate, or watching the Star Wars: The Last Jedi for $100. They’re good, but don’t they seem overpriced?

Historically, investors have paid on the average about 16x the profits of the top 500 U.S. companies (S&P 500). That’s considered a fair price.

Today, investors are pricing U.S. companies at more than 32x their profits. The only time it was higher than this was during the height of the dot-com bubble in the late 1990s.

(The Shiller Price-to-Earnings ratio, from multipl.com)

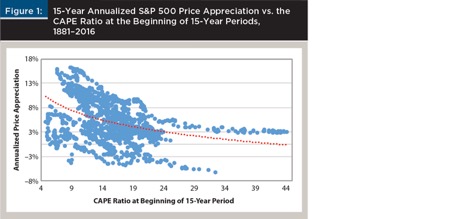

3) Expect lower returns for the U.S. stock market over the next decade. Studies have shown that 15-year annualized returns are lower during periods when prices are high at the beginning of those periods.

(Original data from Shiller, 2016. Graph from Luskin, 2017).

Is there an alternative to U.S. stocks?

4) Emerging market stocks may be the best driver of long-term portfolio growth, given (a) more than half of global economic growth is expected to come from emerging economies, and (b) attractive pricing (it’s only selling at about 15x companies’ profits).

But they are not for the faint-hearted, given its more fierce swings. For example, emerging market stocks decreased by more than 50% during the 2008 recession, then recovered by more than 75% the next year.

There are also other attractive investments, such as emerging market bonds, international small companies, and alternative funds.

In 2018, the questions we should be asking ourselves regarding our 401(k) and IRA are:

- Is my portfolio diversified, so I am not just counting on U.S. stocks for long-term growth?

- Am I taking sufficient risk or too much risk?

- Will I have the interest, time, and discipline to analyze and make the necessary changes in my hard-earned savings?

If you’re unsure, let 2018 be the year when you finally decide to hire an expert who can help you be smarter with your money. Schedule a free discovery call with our firm today.

Engage us on Facebook

Follow us on Twitter

Tweets by @mymcmedia