Blog: How Do Employee Stock Purchase Plans Work?

Do you want to fully understand and maximize your employee stock purchase plan at work? Here are twelve tips to help you get there!

#1 What is an employee stock purchase plan?

An employee stock purchase plan (ESPP) is a benefit offered by several large companies such as Hilton, Disney or Apple. It allows you, as an employee, to buy company stock at a discounted price.

You can usually purchase ESPP plan stock worth 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year.

If you participate, your employer will deduct your contribution directly from your paycheck. Your employer will then purchase the company stock for you, typically at the end of a 6-month period.

You will usually get an email from Human Resources twice a year, asking if you’d like to participate and whether you’d like to change your contribution amount.

#2 What are the benefits of an employee stock purchase plan?

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%.

For example, if you work and participate in Hilton’s ESPP, you can buy Hilton stock at a 15% discount. If Hilton’s stock is trading at $130/share, they’ll buy it at $110.50/share for you. If you decide to sell it immediately, you get a profit – the difference between your purchase price and the trading or selling price. In this scenario, if you decided to buy $20,000 worth of Hilton stock via their employee stock purchase plan program, with a 15% discount, you would have made a $3,000 profit.

It’s like free money if you play it right.

It gets even better. Most ESPP plans have a lookback provision. This allows you to buy the stock either at the purchase date price or the price when the ESPP plan was offered, whichever is lower. So using the above example, if Hilton’s stock price was $110/share when the ESPP plan was offered to you, the discount can be applied on the $110/share instead of $130/share (trading price), which significantly increases your discount!

#3 Do you pay taxes on an employee stock purchase plan?

No taxes are due when you buy the company stock under an employee stock purchase plan. When you sell the stock, you pay either ordinary income or capital gains tax on the gain, and you pay ordinary income tax on the discount.

If you sell the stock immediately after it was purchased, you will have to pay ordinary income taxes on your gain/profit, based on your federal income tax bracket. If your tax bracket is 24%, then you have to pay 24% taxes on your profit. Your profit is the difference between the price you sold the stock for and the price you bought it for.

In our above example, if you bought 100 shares of Hilton stock via its ESPP plan at $110/share ($11,000 cost), and sold it immediately for $130/share ($13,000 value), then your profit is $2,000. If you’re in the 24% tax bracket, you owe Uncle Sam $480.

If you live in a state with state income taxes, then you also have to pay state income taxes on that profit.

If you sell the stock after holding it for at least one year, the taxation of employee stock purchase plans gets favorable but complicated. Instead of paying an ordinary income tax rate, you pay the lower long-term capital gains rate, which is 15% for most Americans. You also need to sell it at least two years after the ESPP offering period began to get this favorable tax treatment (remember that Human Resources email).

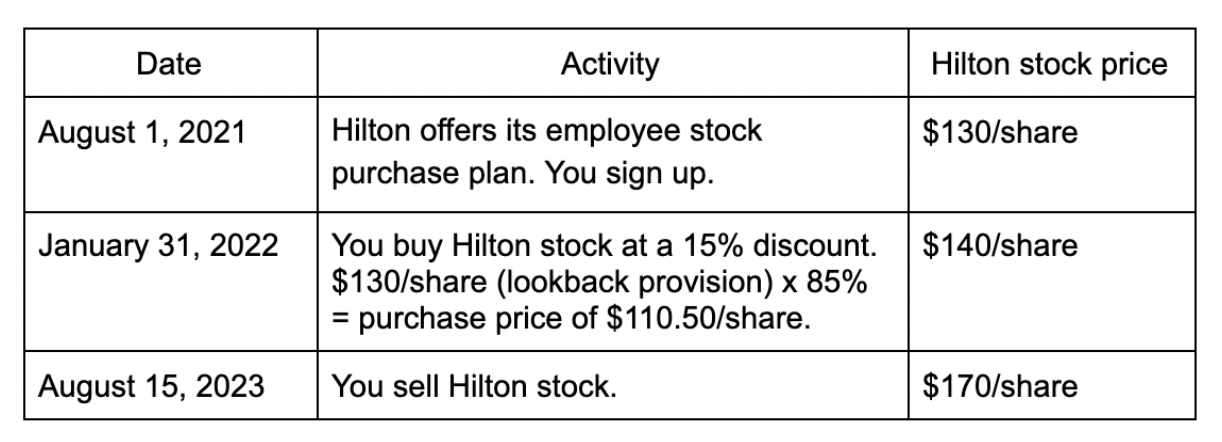

Using our above example, let’s say:

What are your taxes on this employee stock purchase plan example?

Ordinary income taxes:

– With an ESPP, you pay ordinary income taxes on the discount portion of the purchase.

– Compute the difference between: Either Hilton stock price at offering ($130/share) or when they purchased it for you ($140/share), whichever is lower ($130/share); and the price you bought it ($110.5): $19.50/share discount.

– If you bought 100 shares, then your “ordinary income profit” is $1,950.

– If you’re in the 24% federal income tax bracket, then your ordinary income taxes on this sale is $468.

Capital gains taxes:

– Remember that most ESPP plans have a lookback provision, which allows you to buy the stock either at purchase date price or the price when the ESPP plan was offered. In our example, the offering price ($130/share) is lower than the trading price ($140/share), so the discount will be applied at the offering price.

– Compute the difference between the price you sold it for ($170/share) and the offering price ($130/share): $40/share profit.

– Since you bought 100 shares, your “capital gains profit” is $4,000.

– If your capital gains tax rate is 15%, then your capital gains taxes on this sale is $600.

– Total taxes due on this employee stock purchase trade: $468 of ordinary income taxes and $600 of capital gains taxes = $1,068.

– If you did not hold the stock for at least a year after selling it, your total taxes (all ordinary income taxes) would be $1,428 ($170/share less $110.5/share ($59.50/share) times 100 shares times 24% tax rate).

– You saved about 25% in taxes in a qualified sale. ESPP long term capital gains makes a difference.

If you sold the stock for a loss, you can declare that capital loss in Schedule D.

Social Security and Medicare taxes do not apply for ESPP plans.

In summary, are employee stock purchase plans taxable? After you sell the stock, yes. You’ll have to pay ordinary income tax and capital gains tax on the price gain, depending on how long you held it, plus ordinary income taxes on the discount.

#4 Is ESPP reported on W2?

In the year you sell your ESPP shares, your employer may report your “ordinary income profit” on your W-2. This is equivalent to your purchase price discount.

You have to look closely at your W2. If your “ordinary income profit” was not reported, you still will have to report that on your 1040 as “other income.”

Visit https://districtcapitalmangement.com to find out the answers to the other 7 questions about Employee Stock Purchase plans.

Engage us on Facebook

Follow us on Twitter

Tweets by @mymcmedia