Tax breaks for charitable giving aren’t limited to individuals, your small business can benefit as well. If you own a small to medium-size business and are committed to giving back to the community through charitable giving, here’s what you should know. 1. Verify that the Organization is a Qualified Charity Once you’ve identified a charity, […]

Blog: Working Remotely Could Affect Your Taxes

When COVID-19 struck last March, employers quickly switched to a work-from-home model for their employees, many of whom began working in a state other than the one in which their office was located. While some workers have returned to their offices, many have not. If you’re working remotely from a location in a different state […]

Blog: Individual Retirement Arrangements: Terms To Know

While many taxpayers already know about Individual Retirement Arrangements, or IRAs, and have set up an IRA with a bank or other financial institution, a life insurance company, mutual fund or stockbroker, there are other taxpayers such as those new to the workforce who may not understand how IRAs help them save for retirement. With […]

Blog: Tax Preparation vs. Tax Planning

Many people assume tax planning is the same as tax preparation, but the two are quite different. Let’s take a closer look: What is Tax Preparation? Tax preparation is the process of preparing and filing a tax return. Generally, it is a one-time event that culminates in signing your return and finding out whether you […]

Blog: Choosing a Retirement Destination: Tax Considerations

With health care, housing, food, and transportation costs increasing every year, many retirees on fixed incomes wonder how they can stretch their dollars even further. One solution is to move to another state where income taxes are lower than the one in which they currently reside. While federal tax rates are the same in every […]

Blog: Taking Early Withdrawals From Retirement Accounts

While taking money out of a retirement fund before age 59 1/2 is usually not recommended, in certain cases, it may be unavoidable, especially during times of economic crisis. If you need cash and have a retirement fund you can tap, here’s what you need to know. Background When retirement plans such as the 401(k) […]

Blog: Tax Treatment of Virtual Currency Transactions

Whether you’ve invested in Bitcoin and sold it at a profit or loss or received it for services performed, you’ll need to report it on your tax return. Here’s what you should know: Background Prior to 2014, there was no IRS guidance and many people did not understand that selling virtual currency was a reportable […]

Blog: Tax Considerations When Hiring Household Help

If you employ someone to work for you around your house, it is important to consider the tax implications of this type of arrangement. While many people disregard the need to pay taxes on household employees, they do so at the risk of paying stiff tax penalties down the road. Household Employee Defined If a […]

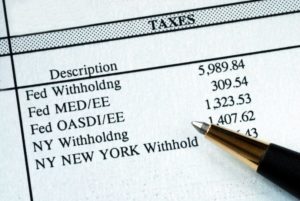

Blog: It’s Never Too Early to Check Tax Withholding

While it probably seems like tax season just ended, it is never too early to do a “Paycheck Checkup” to make sure the right amount of tax is withheld from earnings – and avoid a tax surprise next year when filing your 2020 tax return. As a reminder, because income taxes operate as a pay-as-you-go […]

Blog: Small Business Update: Payroll Tax Deferral

On August 8, 2020, the President issued a Memorandum allowing employers to defer withholding and payment of an employee’s portion of the Social Security tax (i.e., the 6.2% FICA portion of the federal payroll tax on employees). Medicare taxes, however, are not covered. The payroll tax deferral is effective starting September 1, 2020, and also […]

Engage us on Facebook

Follow us on Twitter

Tweets by @mymcmedia