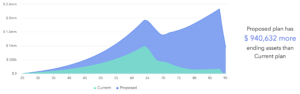

According to Einstein, what is the most powerful force in the universe? The power of compounding. We see that at work with Katie and Haley’s retirement savings. Meet Katie Katie is a recent prospective client of our firm. She is just 25 years old, and already seeking out a financial planner. She’s been working for […]

4 Tips to Wipe Out Credit Card Debt

Do you feel the burden of credit card debt? Imagine what it feels like, if you didn’t have to make those monthly payments. Credit card debt affects people across all income levels. We have a client who works at a large technology company but feels stuck with a $40,000 credit card debt. We have another […]

How to Lower Your Student Loan Payments – And Fund a Trip to London

Are you struggling to pay off your student loans? So is our friend Katie. She’s from Kansas City, works for a social justice non-profit in DC, and is all fired up after finishing her graduate studies. However, Katie has accumulated $80,000 in federal student loan debt and $20,000 in private loans. She makes $70,000 a […]

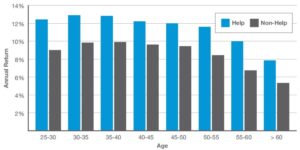

7 Reasons Why You Haven’t Hired a Financial Planner – And Why They’re All Wrong

Many Americans choose to go it alone with their finances instead of hiring a certified expert. Hiring a financial planner is not yet part of our mainstream culture. Yet, if we are willing to pay a mechanic to change our car’s oil or a plumber to fix a leaky sink – even though we could […]

Should you buy Bitcoin?

“Technology has advanced greatly, but human psychology is still the same.” I’m an aggressive investor. When stocks were tumbling during the Great Recession and everyone was running for the exit, I was buying stocks left and right. I even deployed most of my emergency funds. Those kinds of deep bargain opportunities only happen a few […]

God vs. Your Financial Planner

I’d like to share my blog post (below) that was recently published at the Millennial, an online journal that provides Catholic opinion on the most pressing issues of our times in politics, religion, and culture. ________________ As a financial planner, I encourage people to take control of their finances and plan for their future. I often […]

5 Tips to Prepare for GOP Tax Bill

Significant tax changes are being discussed in Congress. If approved, these will take effect in 2018. Many deductions may be eliminated. While the proposed legislation is not yet a done deal, consider the following tax planning opportunities by end of 2017: If you pay estimated taxes, make your final state tax payment in December, instead […]

How GOP Tax Plan May Affect You

2017 Taxable Income How You May Feel Reason Single $0 to $9,235 Why me? Small tax hike (up to $190) $9,326 to $37,950 TY Small tax cut (~$280 to $1,100/yr) $37,951 to $45,000 Yay! Decent tax cut ($4,900 to $5,800/yr) $45,001 to $91,900 Meh […]

Protect Yourself from Latest Equifax Breach

Yesterday, Equifax revealed that sensitive information such as Social Security numbers of 143 million customers were stolen through a cyberattack. That’s close to half the U.S. population. Equifax is one of the three major credit reporting agencies. Here are four things we can do to mitigate potential damage to our credit: 1) Enroll in Equifax’s free credit […]

Thinking of Switching Careers? Consider Being a Financial Planner

The ideal job has three secret ingredients: purpose, mastery, and autonomy. You have all three in a financial planning career. Six years ago, my favorite pastime was to read personal finance magazines. I would learn a lot, and could immediately apply it to my personal life. “Follow these three steps to boost your credit score,” […]

Engage us on Facebook

Follow us on Twitter

Tweets by @mymcmedia