Maryland Joins Lawsuit Against Federal Government Over 2017 Tax Law

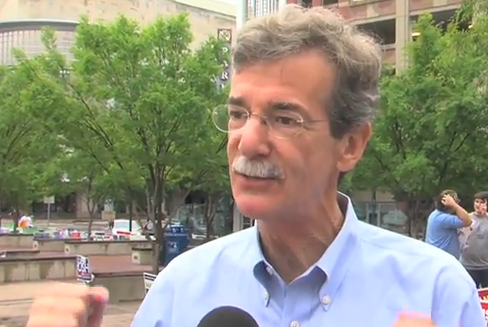

Maryland’s Attorney General, Brian Frosh, has joined a lawsuit against the federal government for the Tax Cuts and Jobs Act of 2017.

The measure, passed by Congress last December, reduces State and Local Tax (SALT) deduction for individuals, married taxpayers, and businesses.

Frosh joined the Attorneys General of New York, Connecticut, and New Jersey, who argues that the new SALT cap was enacted to target certain states.

“Eliminating the SALT deduction will jack up taxes for more than half a million Marylanders,” said Frosh. “It is an attack on state sovereignty. It will reduce funding for local law enforcement and for construction of infrastructure state wide, and it will cripple our ability to educate our kids.”

The lawsuit seeks to invalidate the new $10,000 cap on the federal tax deduction for state and local taxes, according to a spokeswoman from the Maryland Attorney General’s Office.

Engage us on Facebook

Follow us on Twitter

Tweets by @mymcmedia