Many County Homeowners Claiming Tax Credits Incorrectly

The Montgomery County Department of Finance’s Tax Compliance Office issued its first quarter report on the results of its property tax compliance efforts. The report identifies nearly 5,000 accounts that should be corrected that could save the County up to $3.3 million in revenues each year.

The Montgomery County Department of Finance’s Tax Compliance Office issued its first quarter report on the results of its property tax compliance efforts. The report identifies nearly 5,000 accounts that should be corrected that could save the County up to $3.3 million in revenues each year.

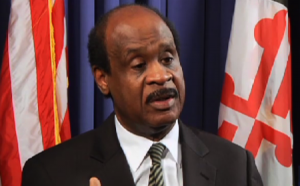

The program was established in May 2012 by County Executive Ike Leggett, with the support of the County Council, and since then has generated actual revenues of more than $1.2 million.

The Homestead Tax Credit program benefits many eligible homeowners every year. One of the requirements for eligibility is that the homeowner must reside in the home. Because I felt the County was losing millions of dollars annually due to credits being mistakenly issued, I created the Tax Compliance Office to work with the state to verify that credits are accurately issued,” said Leggett.

The process employed by the Tax Compliance Office includes searching two main sources – MRIS listings (Metropolitan Regional Information Systems) and the County’s Department of Housing and Community Affairs rental list. Properties that are found to be non-compliant are sent to the State Department of Assessments and Taxation (SDAT) for verification. SDAT verifies the list and informs the County when to mail SDAT Verification Letters to the changed accounts.

“We will continue to diligently work with the State Department of Assessments and Taxation to identify and correct tax assessment records to generate additional savings for the County and ensure the integrity and equity of the County’s property tax system,” said Finance Director Joe Beach.

During the 16 months that the Homestead Compliance Unit has been in existence, the process of ensuring compliance has become significantly more efficient. After months of research, the office has found that the most reliable resources are MRIS, DHCA Rental List and callers who report non-owner-occupied homes..

The Homestead Property Tax Credit was established by state law to help homeowners deal with large assessment increases on their principal residence. The credit limits the amount of assessment on which a homeowner actually pays taxes for their principal residence. The credit does not apply to rental or vacation properties.

For more information about the Tax Compliance program, call 240.777.8860. For information about the Homestead Property Tax Credit, go to http://www.dat.state.md.us/sdatweb/homestead.html.

Engage us on Facebook

Follow us on Twitter

Tweets by @mymcmedia